What if your 9-6 job became a stepping stone to financial abundance? Dive into investment ideas curated for working professionals, and let your money work for you.

In a world where uncertainty looms and the future remains unpredictable, it’s crucial for you to take control of your financial destinies. Failure to build a robust trading portfolio could leave you vulnerable to the whims of a volatile market, potential economic downturns, or unforeseen life events. The fear of missed opportunities and the anxiety of not being prepared for what lies ahead can cast a long shadow over your financial future. Specially when you are a working professional stuck into your 9-6 job.

However, in a world brimming with financial opportunities, the decision to embark on a journey of trading portfolio mastery holds immense significance. This blog serves as your guiding light, unveiling the hidden potential within working professionals and revealing the secrets to building successful trading portfolios.

By delving into the intricate nuances of the stock market, you will learn invaluable strategies to navigate challenges, optimize time management, and leverage your unique skills. Failure to explore these insights means missing out on the chance to secure a prosperous financial future, leaving you susceptible to missed opportunities and potential setbacks.

So, don’t let indecision or a lack of knowledge hinder your progress. Discover the power within and unlock the door to a world of financial success.

In a world of uncertainties, take the proactive approach and empower yourself with the knowledge and skills needed to thrive in the trading world. Embrace the thrill of controlled risk and maximum profits as you embark on a journey towards trading portfolio mastery.

Let this blog be your compass, guiding you through the intricacies of the market and revealing the hidden potential within you.

With the right mindset, strategies, and discipline, you can navigate the challenges and seize the opportunities that the market presents. Don’t let fear dictate your financial fate; seize the power and embark on a journey to trading portfolio mastery.

Together, let’s uncover the secrets that will unlock your potential and pave the way for a brighter financial future.

Challenges of 9-6 Job

Hey there, fellow working professional. I know firsthand the struggles we face in trying to balance our jobs with our aspirations in the stock market. Our busy schedules and limited availability make it feel like time is slipping through our fingers.

The world of trading may seem like a distant dream, wrapped in a shroud of unfamiliarity. We yearn to break free from the constraints that hold us back, to unlock the secrets of the market.

But fear not, my friend, for within these challenges lie the untapped potential that can lead us to financial success. Together, let’s conquer our limited knowledge, master the art of investment, that will transform our lives.

In the vast world of trading, there are lesser-known strategies and techniques that can unlock the full potential of your trading portfolio. I know it’s exciting when using advanced strategies like swing trading, trend following and, mean reversion, .

Although it’s not just about the strategies; but about protecting your portfolio. Explore risk management, where position sizing, stop-loss orders, and diversification act as safeguards. If you master these hidden gems, you’ll feel a sense of fulfillment like never before.

But, it is not easy to master as it takes lots of time to learn and practice in live market.

I understand your dilemma, juggling a demanding job at an MNC while yearning for financial growth.

The burning question on your mind is: Can i make money in the stock market without any prior knowledge? Well, let me reveal to you the simplest and most effective path to multiplying your capital in the stock market.

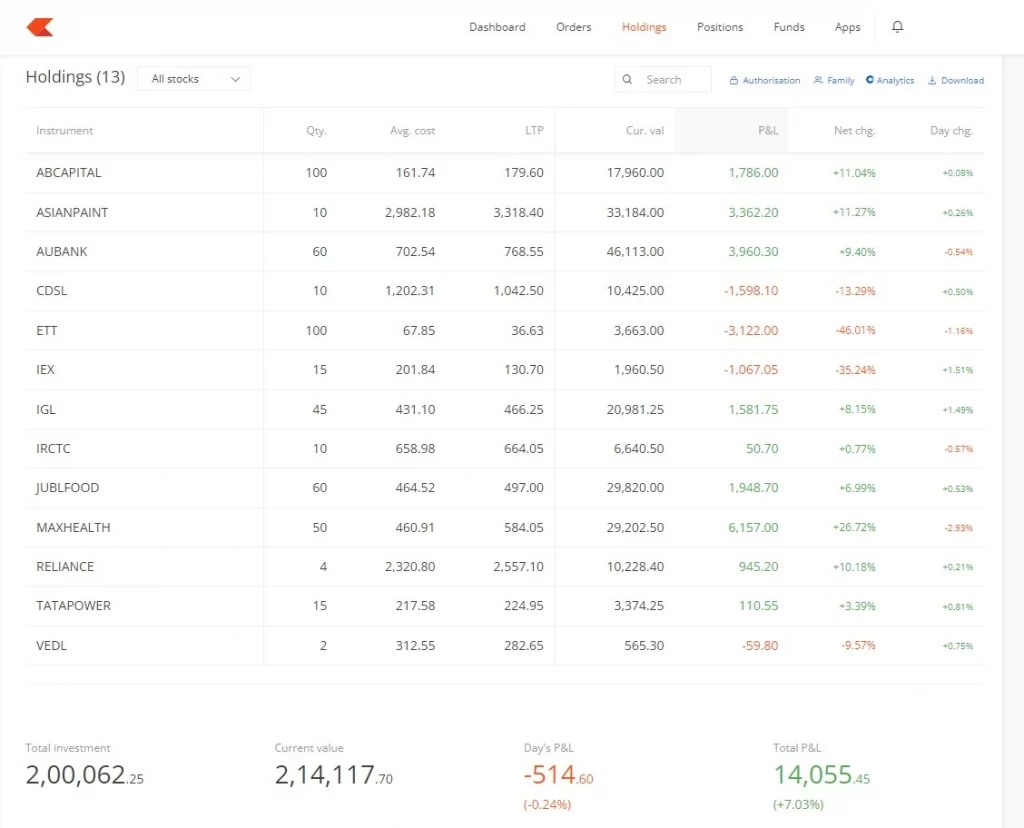

Example: Portfolio Crafted along a 9-6 Job

Picture this: a portfolio carefully crafted over the course of 7-8 months. along with a very hectic job schedule usually from 9-6, fueled by investing 50% of your hard-earned paycheck each month.

The secret lies in a strategy that demands a fixed amount of your earnings to be dedicated to investing in a diversified selection of 20 stocks. Above all, the exact amount you invest will depend on your personal financial situation and goals, but I highly recommend allocating at least 20-30% of your monthly earnings.

Strategy: How to build portfolio along with your 9-6 Job

Now, let’s dive into the nitty-gritty of this winning strategy. Our portfolio will consist of 20 different stocks, carefully curated to include 10 steadfast performers and top-notch blue chip stocks. Complementing these stalwarts will be 6 stocks from the promising midcap space, with an additional 4 stocks from the low cap segment.

To build your dream portfolio, begin by shortlisting 10 fundamentally strong blue-chip stocks. Aim to invest in the leading stock of each sector.

Exemplifying this strategy with Indian stock market icons such as Asianpaint, ICICIBANK, Hindustan Unilever, Drrreddy, Apollo Hospital, TCS/INFY, and more.

Observe closely, and you’ll realize that our investment selection predominantly focuses on sectors directly connected to consumers. Why, you may ask?

Well, companies catering directly to consumers are known to transcend market cycles and economic downturns, offering a more stable investment foundation.

To unearth exceptional midcap and smallcap stocks, I invite you to visit our Instagram page or join our Telegram channel. There, we regularly share investment opportunities that hold immense potential for growth.

Now, let’s address a crucial aspect: how and when to deploy your hard-earned capital. Allow me to introduce my ingenious 15% correction technique.

Each month, the portion of your investment should be allocated to those trading at least 15% below their recent highs.

It’s important to note that if a stock’s price drops below your last buying price, refrain from further investment.

By adhering to this method, you’ll naturally create a cycle of investment.

Because different stocks reach their 15% correction levels at varying times.

This approach ensures a healthy growth trajectory for your portfolio, favoring the consistent performers.

Lastly, let’s discuss the importance of booking profits and reshuffling your stock selection. I recommend changing a stock if it fails to demonstrate growth within a year. Also, we will not add capital in any stock that is not trading above the previous buying price. This prudent move allows you to continually optimize your portfolio and capitalize on emerging opportunities.

Conclusion

After all, by embracing this proven strategy, you’ll set yourself on a path towards financial prosperity. No longer will you feel like a novice lost in the stock market labyrinth. Keep investing the funds in a systematic manner for 3-5 years and it will put you ahead of the middle class trap. Remember, the key lies in consistent and informed decision-making. Start building your future today and watch your capital soar to new heights.